Two big issues with some of the conditions I see in these letters are: I also see letters that offer to pay a settlement, but only if the creditor or debt collector can prove the debt is owed and valid. If this an agreeable settlement, please confirm your acceptance via mail to the above address. I can offer you _ dollars in order to completely settle and resolve the above referenced account.

I am not in great financial shape today, but have some resources that a family member has agreed to provide, in order to start digging my way out of debt. I am experiencing an ongoing financial hardship, and have only been able to keep up on necessary bills. RE: Account # or Collection Agency File # It does not contain some of the problematic issues I discuss in this article, but is still something I would not use when trying to negotiate and settle a debt. Some of us may approach this effort with a specific credit reporting outcome, such as getting the negative account deleted from your credit bureau reports as a condition of paying the settlement.īelow is an example letter of a settlement offer I have seen mailed out. The goal of sending a settlement offer letter is to pay less than what you owe and put that account in your rearview mirror. Related article: Help, I’ve been sued by a debt collector! Some of the settlement offer letter examples I see used are not viewed as an offer at all.

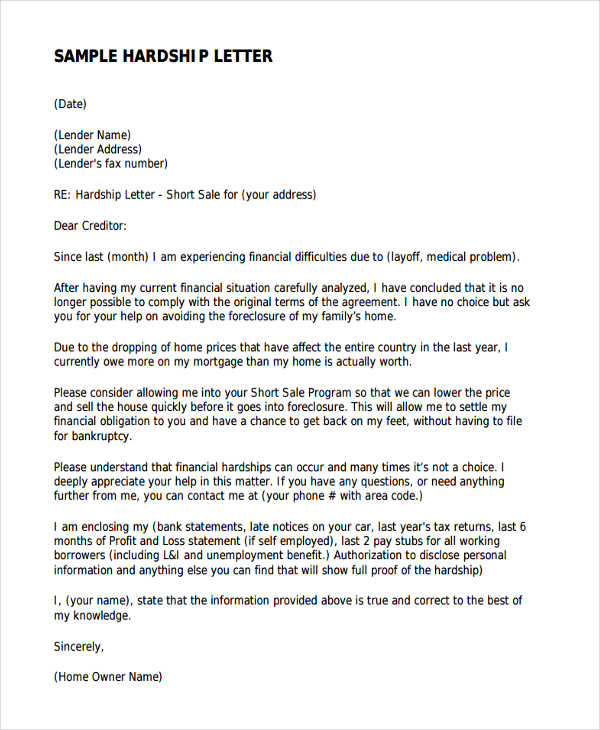

I really only want to negotiate with the debt collector whose pay is partially based on how much debt they collect that month, and not someone who may not have that incentive, and whose job may also be geared toward pursuing collections in the court. If your creditors, or the debt collection agency that has your account, has a mailroom practice of sending settlement offer letters to their internal legal team, this is typically the last department I want to deal with. Here are some reasons why sending a settlement offer letter can hurt you: Your creditor’s and collector’s mailroom may not process and forward your offer letter correctly. In fact, negotiating through the mail is often counterproductive to reaching your goal. The Federal Office of Personnel Management provides templates you can use to write a hardship letter to a creditor.I am not a big fan of sending your creditors and debt collectors a written offer letter to settle your debt for less.

0 kommentar(er)

0 kommentar(er)